Investment Return Comparison

See how different expected investment returns affect your long-term financial outcomes.

Simulation Overview

This simulation varies a single parameter while keeping all other assumptions constant.

Base scenario assumptions

- The simulation starts at age 30 and runs until age 65.

- The initial annual income is €20,000.

- Income grows annually at an average rate of 2%.

- An income tax rate of 10% is applied to gross income.

- The saving rate is set to 5%.

- Minimum annual living expenses are €14,000.

- Savings are invested with stochastic annual returns.

- The average annual return is 5%, with year-to-year variability.

- All values are expressed in real terms, assuming average annual inflation of 2%.

- The simulation includes stochastic life events such as unemployment, and health issue.

- These events may temporarily affect income, expenses, or net worth.

- Financial independence is defined as having net worth equal to 25 times annual expenses.

- Bankruptcy is triggered if net worth remains below €0 for 2 consecutive years.

Scenario Comparison

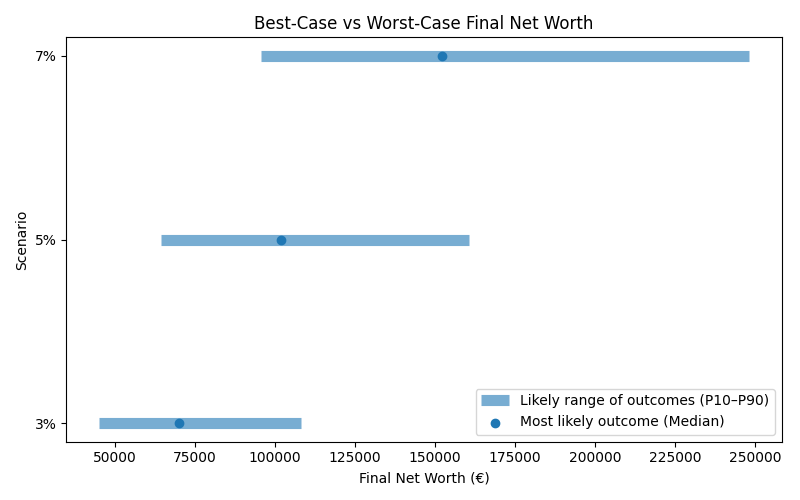

Results are shown as a realistic range. P10 represents a pessimistic outcome (bad years, poor returns), while P90 represents an optimistic outcome (strong markets, good timing). Most simulations fall between these two values.

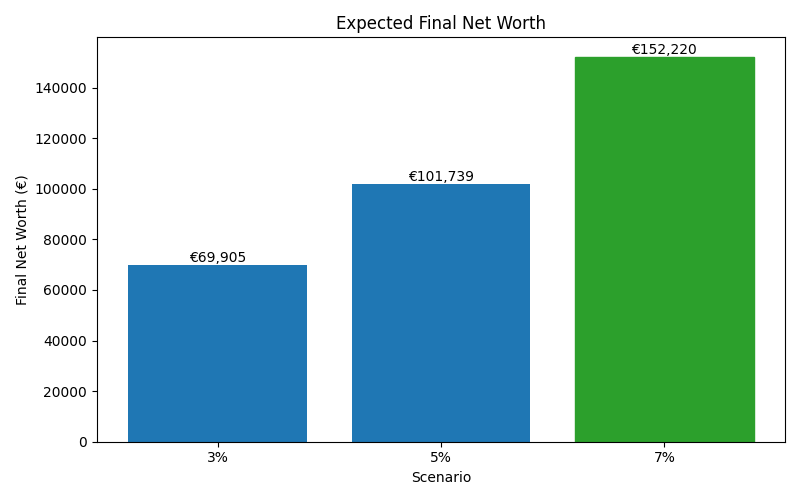

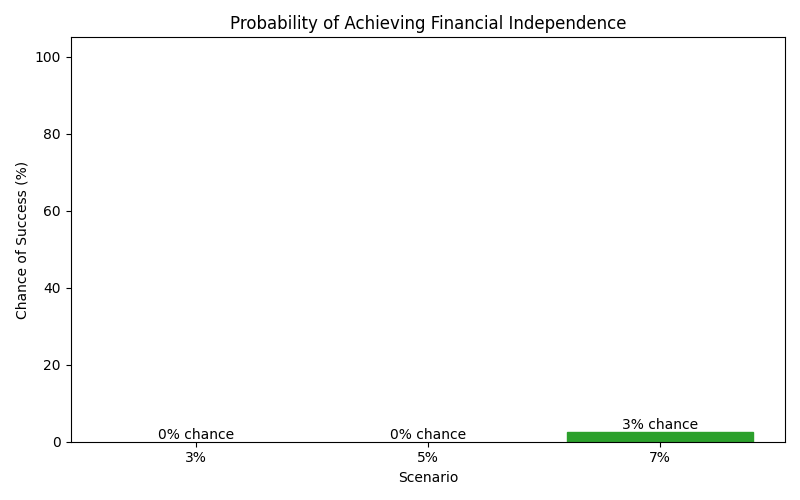

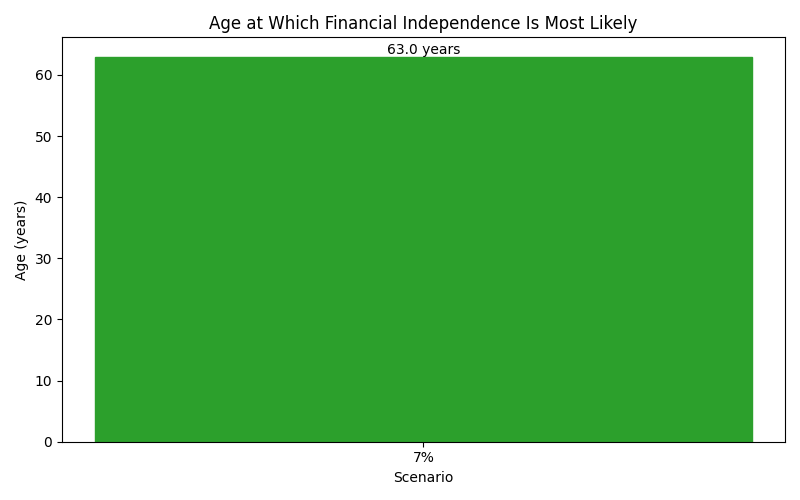

| Scenario | Median Net Worth | P10 Net Worth | P90 Net Worth | FI Probability | FI Median Age |

|---|---|---|---|---|---|

| 3% | 69,905.465 | 44,932.943 | 108,158.686 | 0% | None |

| 5% | 101,739.16 | 64,501.818 | 160,726.23200000002 | 0% | None |

| 7% | 152,220.15999999997 | 95,658.06300000001 | 248,146.288 | 2% | 63 |

How Your Financial Life Evolves

These charts show how each scenario affects long-term outcomes, including expected wealth, downside risk, and the likelihood of achieving financial independence.

Median net worth

Net worth outcome range (p10–p90)

Financial independence probability

Median age of financial independence

What This Means for You

The numbers above translate into real-life trade-offs between risk, reward, and the age at which financial independence becomes most likely.

Next Step

Want to explore a different assumption or see how sensitive your plan is to change?

🔁 Adjust Investment Return